The ZYNLO Bank More Spending account earns a powerful APY of 2.00% and has no monthly charge or minimum steadiness requirement. You’ll have access to over 55,000 free Allpoint ATMs and can make limitless withdrawals out of your account. The BMO Good Money Checking is a primary personal checking account that’s perfect for youthful adults, because the account’s $5 is waived for individuals under the age of 25. To open the account, you’ll have to deposit a minimal of $25. As a local people bank, we at ESSA Bank are committed to serving the continued development and well-being of the areas in which we function. Neighborhood involvement for us goes well past our mission to offer high-quality banking services — charity, in any case, begins at house, and our house is right the place you reside.

Truist One Checking

Payment requests to persons not already enrolled with Zelle® have to be despatched to an e-mail handle. For extra data, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Settlement. Account charges (e.g., monthly service, overdraft, Small Enterprise Account Analysis fees) might apply to Wells Fargo account(s) with which you utilize Zelle®. It provides a selection of banking companies https://execdubai.com/, including bank cards, mortgages, investments, loans, and of course, financial institution accounts. SoFi Checking and Savings offers a aggressive APY, and if you open this savings account, you mechanically get a checking account too.

Chase Premier Plus Checkingsm

Ally, certainly one of Forbes Advisor’s picks for the highest on-line banks, appears at your credit score information if you open an account, but this won’t affect your credit score rating. This account earns an APY of 0.10%, which is lower than some other interest-earning checking accounts. This account presents the opportunity to earn up to a 4% annual bonus on balances and is fee-free. 2We’ve partnered with Allpoint to give you ATM access at any of the 55,000+ ATMs inside the Allpoint network.

Our Best On-line Checking Accounts November 2025

- Typically, you’ll be required to obtain a direct deposit of a sure quantity inside a selected time frame to be eligible.

- Certain conditions have to be happy for pass-through deposit insurance coverage coverage to use.

- $15 OR $0 for faculty kids years old at account opening, enrolled in school, or a vocational, technical, or trade college as much as the graduation date offered at account opening (five years maximum).

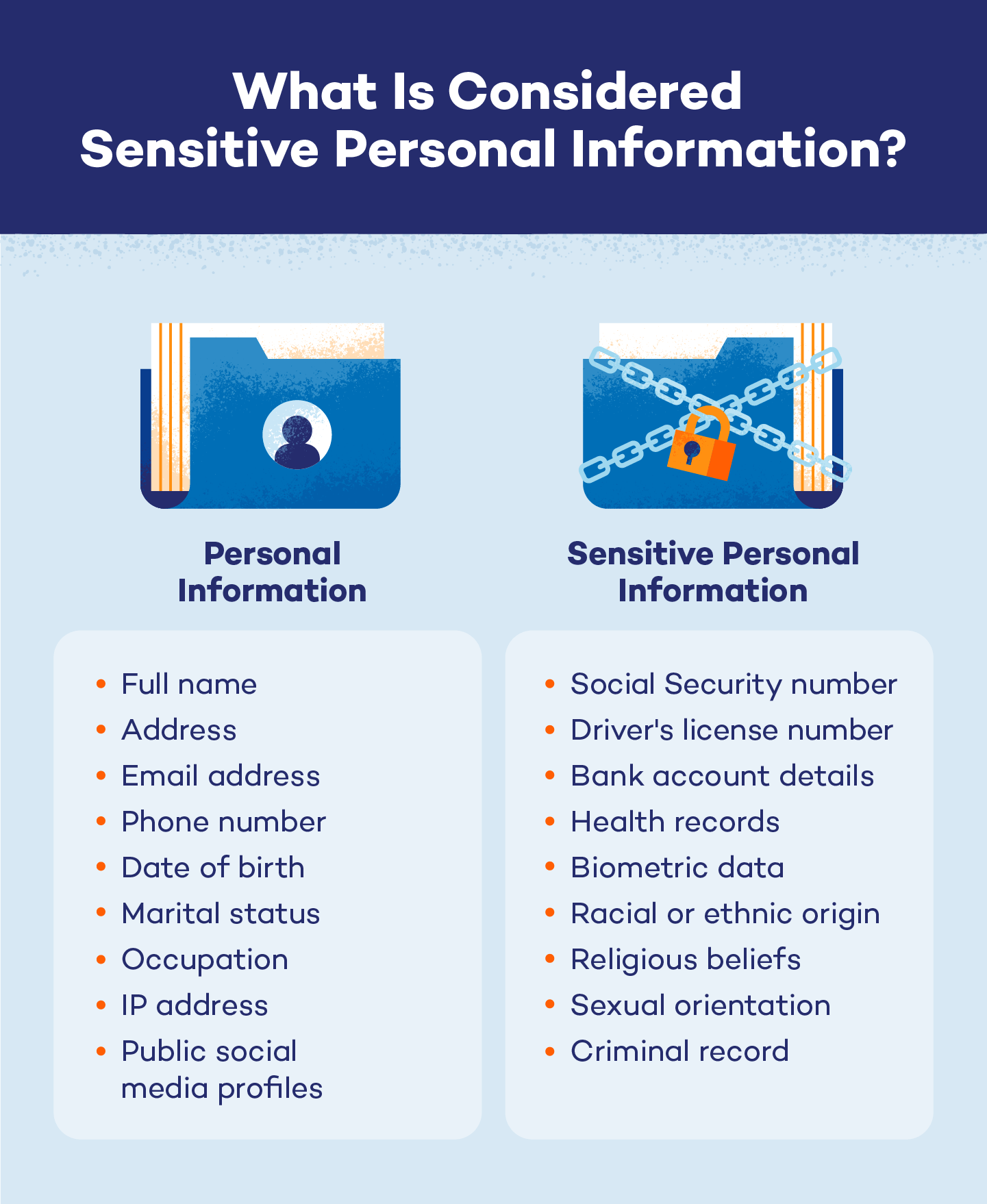

To apply, you’ll need to offer your name, contact info, citizenship status, Social Security number or ITIN and, in some circumstances, a photo ID to confirm your identity. Say bye to long waits, fantastic print, and safety considerations. Say hiya to providers that really serve, with a dedicated staff ready to assist at any time of day. Consolidate debt, improve your own home, or handle huge expenses with a low fixed-rate loan—and no fees. On An Everyday Basis Checking has extra options to keep away from the fee.

Do I Would Like To Switch Banks To Be Eligible For A Checking Account Bonus?

Early access to direct deposit funds is dependent upon the timing by which we obtain discover of impending direct deposit, which is usually as a lot as two days earlier than the scheduled deposit date. Similar web page link returns to footnote reference 8Enrollment in Zelle® at a participating financial institution utilizing an eligible U.S. checking or financial savings account is required to use the service. Chase customers may not enroll utilizing financial savings accounts; an eligible Chase shopper or enterprise checking account is required, and should have its own account fees. Funds are usually made out there in minutes when the recipient’s email handle or U.S. cell number is already enrolled with Zelle® (go to enroll.zellepay.com to view taking part banks). Choose transactions might take up to three enterprise days. Disclosure 1 For your safety, Zelle® ought to only be used to ship cash to friends, family, and different people or businesses you belief.