Doing this break-even evaluation helps FP&A (financial planning & analysis) teams decide the suitable sale price for a product, the profitability of a product, and the finances allocation for every project. It is the financial value https://www.quickbooks-payroll.org/ that every hour worked on a machine contributes to paying fastened costs. You work it out by dividing your contribution margin by the variety of hours labored on any given machine.

If all variable and glued prices are lined by the promoting value, the breakeven level is reached, and any remaining quantity is revenue. However, a super contribution margin evaluation will cover each mounted and variable price and help the business calculate the breakeven. A high margin means the profit portion remaining in the business is extra. It might turn into negative if the variable value is extra that the revenue can cover. The contribution margin tells us whether or not the unit, product line, department, or company is contributing to covering fastened costs.

Whether Or Not you sell millions of your products or 10s of your merchandise, these expenses remain the same. Mounted and variable prices are expenses your organization accrues from operating the enterprise. In brief, profit margin gives you a general idea of how well a enterprise is doing, whereas contribution margin helps you pinpoint which merchandise are probably the most profitable. A surgical suite can schedule itself efficiently but fail to have a optimistic contribution margin if many surgeons are sluggish, use too many instruments or costly implants, etc.

Variable Prices Versus Fixed Costs

She is a former CFO for fast-growing tech firms with Deloitte audit expertise. Barbara has an MBA from The University of Texas and an lively CPA license. When she’s not writing, Barbara likes to analysis public firms and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. The contribution margin is of great significance to companies for several causes, that are outlined below.

Contribution Margin Instance Calculation

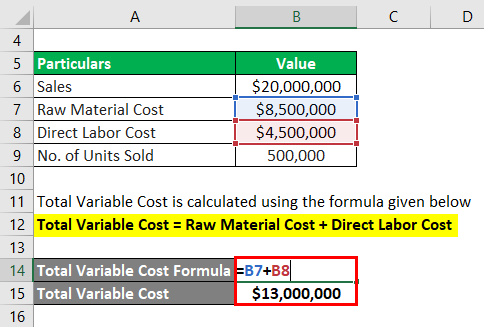

- The calculation of the values is carried out using the relevant contribution margin method.

- Businesses calculate their contribution margin as a total contribution margin or per-unit amount for products.

- It indicates whether your organization is successfully generating profit from its gross sales.

- Web margin (more generally known as net revenue margin) is the ratio of web profit to revenue (net profit ÷ revenue), demonstrating how much net revenue is earned per dollar of income generated.

- Contribution margin analysis helps you set the best worth and resolve on bundles.

The contribution margin measures how effectively an organization can produce merchandise and keep low levels of variable costs. It is taken into account a managerial ratio as a outcome of corporations rarely report margins to the public. As An Alternative, management uses this calculation to help improve internal procedures within the manufacturing process.

This Is an instance Contribution Margin, displaying a breakdown of Beta’s three main product strains. Essential to understanding contribution margin are mounted prices and variable prices. On the other hand, variable costs are prices that rely upon the amount of products and services a business produces. The more it produces in a given month, the extra raw materials it requires.

Healthtech is considered one of the most necessary industries for the long run because they are constantly engaged on the means to change and improve our high quality of life. Hardware founders ought to concentrate on product development quite than finance problems. With the assistance of an skilled accountant, you’ll know that your funds will be accomplished accurately and on time each single month. At Finvisor, our team focuses on helping early-stage entrepreneurs with everything from accounting and bookkeeping to offering priceless assist as your organization grows. The following incessantly asked questions (FAQs) and answers relate to contribution margin. The following diagram exhibits an outline of some important reasons for the contribution margin.

This highlights the margin and helps illustrate the place a company’s bills. Variable bills can be compared yr over 12 months to determine a pattern and show how income are affected. While there are plenty of profitability metrics—ranging from the gross margin down to the web revenue margin—the contribution margin metric stands out for the analysis of a specific services or products. In the simplest phrases, the contribution margin is like your business’s report card. It tells you how much cash each product or service is contributing to cover your fastened costs and start making a profit. A contribution margin represents the cash made by selling a product or unit after subtracting the variable costs to run your small business.

The relative contribution margin also lets you identify an optimized manufacturing program. Contribution margin measures the profit generated by the manufacturing and sale of individual units. Net margin (more commonly known as web profit margin) is the ratio of net profit to revenue (net profit ÷ revenue), demonstrating how much web revenue is earned per dollar of revenue generated.

The contribution margin per hour of OR time is the hospital revenue generated by a surgical case, much less all of the hospitalization variable labor and supply prices. Variable prices, corresponding to implants, range directly with the volume of instances carried out. Extra importantly, your company’s contribution margin can inform you how much revenue potential a product has after accounting for particular prices. The concept of contribution margin is relevant at varied levels of manufacturing, business segments, and merchandise. Investors and analysts may also try and calculate the contribution margin determine for a company’s blockbuster products. For instance, a beverage company could have 15 totally different products, but the bulk of its profits may come from one particular beverage.

The formula to calculate the contribution margin is the same as revenue minus variable costs. Likewise, a restaurant owner needs things like espresso and pastries to promote to guests. The extra clients they serve, the extra food and beverages they have to purchase.